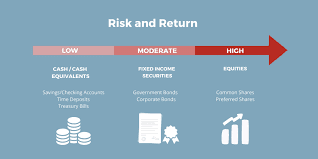

Investing might seem straightforward, but it's not as simple as it sounds. It's crucial to understand the risks involved to make informed decisions and achieve better returns while aligning your investments with your goals and risk profile. Risk: In investment terms, risk refers to the possibility of losing money or not earning the expected return on your investment. There are several kinds of investments, and it's important to know how much risk you can tolerate. Return: Return, on the other hand, is the profit or loss generated from an investment over a certain period. It's the reward you receive for taking on investment risk. Risk Tolerance: This is your ability and willingness to tolerate fluctuations in the value of your investments. It's influenced by factors such as your financial situation, investment goals, time horizon, and psychological makeup. Risk Appetite: This refers to how much risk you're willing to take to achieve your investment objectives. It's influenced by your investment goals, time horizon, and comfort level with uncertainty. Risk Profile: Your risk profile is a combination of your risk tolerance and risk appetite. It helps determine the types of investments that are suitable for you based on your financial goals, time horizon, and willingness to take on risk. Customized Investment Strategy: By assessing your risk profile, you can tailor your investment strategy to match your individual preferences and financial goals. Optimal Asset Allocation: Understanding your risk profile helps you determine the right mix of asset classes, such as stocks, bonds, and cash, to achieve a balance between risk and return. Reduced Investment Stress: By aligning your investments with your risk profile, you can avoid taking on too much risk or investing too conservatively, which can help reduce investment-related stress. A key idea in investing is balancing risk and return. Generally, investments with higher potential returns also carry higher levels of risk. On the other hand, lesser risk investments usually provide smaller profits. Finding the right balance between risk and return is crucial for achieving your financial goals while minimizing potential losses. Making Well-Informed Decisions: Depending on your unique risk tolerance and financial objectives, you can make well-informed investing decisions by comprehending the link between risk and return. Maximized Returns: By taking on an appropriate level of risk, you can potentially earn higher returns on your investments over the long term, helping you achieve your financial objectives more efficiently. Risk Management: By understanding the risks associated with different investments, you can implement risk management strategies to mitigate potential losses and protect your investment capital. Successful investment requires an understanding of risk and reward. By assessing your risk tolerance, defining your investment goals, and aligning your investments with your risk profile, you can build a diversified investment portfolio that maximizes returns while managing risk effectively. Remember, investing is a long-term journey, and taking a balanced approach to risk and return is key to achieving your financial objectives.Understanding Risk and Return in Investments

Understanding Risk and Return in Investments

Benefits of Risk Profiling

Balancing Risk and Return

Conclusion

Navigating through different stages of life requires careful financial planning, akin to charting a course through changing landscapes. Unlike planning a weekend getaway, financial planning demands a thorough understanding of various factors at play. From managing everyday expenses to preparing for major life events, each stage brings its own set of challenges and opportunities.